Term life insurance is a crucial component of financial planning, offering protection and peace of mind for your loved ones in the event of your untimely demise. This guide aims to provide a comprehensive understanding of term life insurance, its types, benefits, costs, application process, and mistakes to avoid. By the end of this guide, you’ll be better equipped to make an informed decision when choosing the best term life insurance policy that aligns with your needs and financial goals.

What is Term Life Insurance?

Term life insurance provides a straightforward and cost-effective solution for those seeking financial security for a specific period, ensuring their loved ones are taken care of in the event of their untimely passing. In this section, we will delve into the definition of term life insurance, its key features, and how it differs from permanent life insurance, offering you a comprehensive understanding of this essential insurance product.

Definition of Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, known as the term. If the insured passes away during the term, the policy pays out a death benefit to the designated beneficiaries such as children or spouses. Unlike permanent life insurance, term life insurance does not accumulate cash value and is typically more affordable.

How Term Life Insurance Differs from Permanent Life Insurance

Unlike permanent life insurance, which provides coverage for the entire life of the insured, term life insurance only covers a specific term. It does not have a cash value component or investment features. Term life insurance is designed to offer affordable coverage for a temporary period, making it an attractive option for those seeking pure life insurance protection.

Types of Term Life Insurance

In the world of life insurance, term life insurance stands out as a flexible and affordable option for individuals and families seeking financial protection. Understanding the various types of term life insurance is essential to make the right decision that aligns with your unique needs and goals. This section will delve into the different types of term life insurance policies available, shedding light on their distinct features and benefits. From level term policies with predictable premiums to convertible policies that offer long-term flexibility, we’ll explore each option to help you gain a comprehensive understanding of term life insurance and its role in securing your financial future.

- Level Term or Level-Premium Policy: Level term insurance offers a fixed premium and death benefit for the entire term. It ensures stable and predictable costs, making it easier to budget for insurance expenses.

- Yearly Renewable Term (YRT) Policy: YRT policies provide coverage for one year, renewable annually without the need for medical reevaluation. However, premiums increase with age and can become expensive over time.

- Decreasing Term Policy: In a decreasing term policy, the death benefit decreases over time while the premiums remain constant. This type of policy is often used to cover specific financial obligations with reducing balances, such as a mortgage.

- Convertible Term Policy: A convertible term policy allows the policyholder to convert the term policy into a permanent life insurance policy without undergoing a medical examination.

- Return of Premium (ROP) Term Policy: ROP policies refund the total premium paid during the term if the insured survives the policy’s duration. It offers a level of savings but tends to have higher premiums compared to regular term policies.

- Group Term Life Insurance: Group term life insurance is provided by employers to their employees as part of a benefits package. It offers coverage for a specified term and may be convertible or portable in certain cases.

Cost of Term Life Insurance

When it comes to securing your family’s financial future, term life insurance is a popular and cost-effective option. Understanding the cost of term life insurance is essential for making informed decisions about your coverage. In this section, we will delve into the factors that affect term life insurance premiums, the comparison between term life insurance rates and whole life insurance rates, and why term life insurance is a practical choice for many individuals and families.

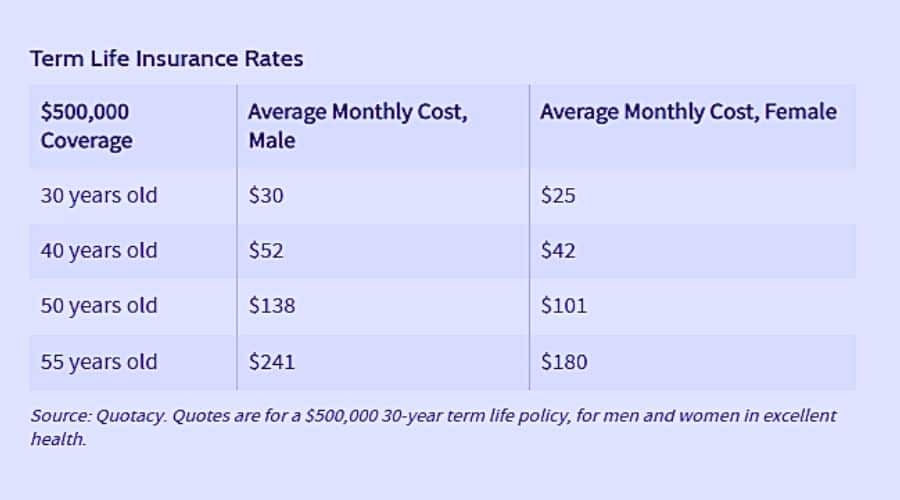

- Factors Affecting Term Life Insurance Premiums: Various factors impact term life insurance premiums, including age, health condition, lifestyle choices, coverage amount, term length, and the type of policy chosen.

- Term Life Insurance Rates: Term life insurance premiums are typically lower than those of permanent life insurance due to the absence of cash value accumulation.

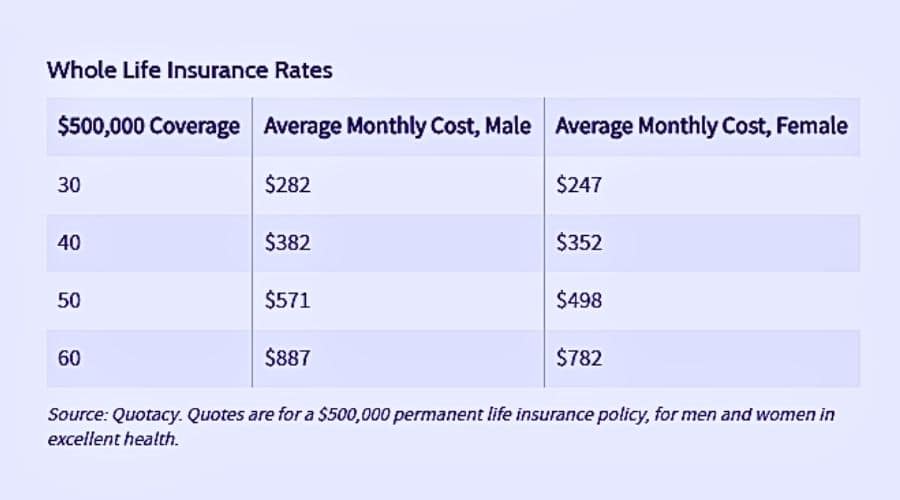

- Whole Life Insurance Rates: Whole life insurance premiums are higher than term life insurance premiums because they include an investment component and offer lifelong coverage.

Benefits of Term Life Insurance

This section explores the benefits of term life insurance, highlighting its significance in providing financial protection, flexibility, and peace of mind for policyholders and their beneficiaries. By understanding the advantages of term life insurance, you can make an informed decision to protect your family’s well-being and ease their financial burden in times of need. Let’s delve into the various benefits that term life insurance has to offer.

- Financial Protection for Your Loved Ones: Term life insurance provides a death benefit to your beneficiaries, helping them maintain financial stability and cover expenses in the event of your passing.

- Affordable Coverage Options: Term life insurance offers cost-effective coverage for specific periods, making it accessible for individuals with budget constraints.

- Flexibility and Customization: With various term lengths and policy options available, term life insurance allows you to tailor your coverage to your unique needs.

- Peace of Mind Knowing Your Family is Protected: Having term life insurance in place ensures that your loved ones will be financially secure if the unexpected happens.

How to Choose the Right Term Life Insurance Policy

Selecting the right term life insurance policy is a crucial step towards protecting your family’s financial future. Term life insurance offers affordable coverage for a specified period, ensuring that your loved ones are financially secure if the unexpected happens. However, with various policy options and insurance providers available, making the best choice can be challenging. This section will guide you through the process of choosing the right term life insurance policy, helping you understand the factors to consider and the options available.

- Assessing Your Coverage Needs: Evaluate your financial obligations, future plans, and dependents’ needs to determine the appropriate coverage amount.

- Selecting the Appropriate Policy Length: Choose a term length that aligns with your financial goals and the duration of your financial responsibilities.

- Considering Additional Riders or Add-Ons: Explore optional riders, such as critical illness or disability coverage, to enhance your policy’s benefits.

- Comparing Different Insurance Providers: Obtain quotes from multiple insurance providers to compare costs, coverage options, and customer reviews.

Understanding the Term Life Insurance Application Process

Understanding the application process is essential to ensure a smooth and successful experience. In this section, we will walk you through the various stages involved in applying for term life insurance.

- Gathering Personal and Medical Information: Prepare necessary documents and information, including medical history, for the application process.

- Undergoing Medical Examinations (if required): Some policies may require a medical examination to assess your health and determine premium rates.

- Waiting Period and Policy Approval: After submitting your application, there may be a waiting period before your policy is approved and coverage begins.

Common Term Life Insurance Mistakes to Avoid

Securing the right term life insurance policy is an essential step towards protecting your loved ones and ensuring their financial well-being in the event of your passing. In this section, we will explore some common term life insurance mistakes that you should be aware of and avoid. By understanding these pitfalls, you can make informed decisions to safeguard your family‘s future and achieve true peace of mind.

- Underinsuring or Overinsuring: Ensure that your coverage adequately reflects your financial needs without overpaying for excessive coverage.

- Ignoring Policy Exclusions and Limitations: Familiarize yourself with the policy’s terms and exclusions to understand what is covered and what is not.

- Letting the Policy Lapse: Maintain consistent premium payments to keep your policy active and avoid losing coverage.

Term Life Insurance for Different Life Stages

Term life insurance is a versatile and valuable tool that can adapt to different life stages, offering essential financial protection for individuals and their loved ones. In this section, we explore how term life insurance can be tailored to meet the unique requirements of various life stages.

- Term Life Insurance for Young Professionals: Young professionals can benefit from affordable term life insurance to protect their loved ones and future financial plans.

- Term Life Insurance for Couples and Families: Term life insurance can provide financial security for couples and families, ensuring their well-being in case of a tragedy.

- Term Life Insurance for Empty Nesters and Retirees: Empty nesters and retirees may still require term life insurance to cover specific financial obligations and protect their legacy.

Term Life Insurance and Financial Planning

Term life insurance provides a cost-effective way to protect your family from the financial burden of unexpected events. In this section, we will explore how term life insurance seamlessly integrates with your broader financial goals, providing a safety net for your family’s future.

- Integrating Term Life Insurance with Your Financial Goals: Incorporate term life insurance as a key element in your overall financial planning to safeguard your family’s future.

- How Term Life Insurance Fits into Estate Planning: Term life insurance can play a significant role in estate planning by providing liquidity and financial support to heirs.

- Tax Implications of Term Life Insurance Payouts: Understand the tax implications of life insurance payouts to make informed decisions about your financial planning.

Term Life Insurance vs. Other Insurance Types

Among the various insurance options available, term life insurance stands out as a popular choice due to its simplicity and affordability. However, it’s essential to understand how term life insurance compares to other insurance types to make an informed decision that best suits your needs.

- Term Life Insurance vs. Whole Life Insurance: Compare the features and costs of term life insurance and whole life insurance to find the right fit for your needs.

- Term Life Insurance vs. Universal Life Insurance: Understand the differences between term life insurance and universal life insurance to choose the most suitable option.

- Term Life Insurance vs. Accidental Death and Dismemberment (AD&D) Insurance: Differentiate between term life insurance and AD&D insurance, which provides coverage specifically for accidents leading to death or dismemberment.

Cribb Insurance Group Inc. Can Help Secure Your Financial Future

Term life insurance is a vital tool for securing your family’s financial future, providing affordable coverage for a specific period. By understanding its types, benefits, costs, and the application process, you can make well-informed decisions that align with your financial goals. Whether you’re a young professional, a couple with a growing family, or an empty nester planning your estate, term life insurance offers peace of mind and financial confidence to face life’s uncertainties.

Cribb Insurance Group Inc. understands the importance of securing your financial future and protecting the ones you love. With our comprehensive range of insurance solutions and expert guidance, we are committed to providing you with peace of mind and financial security. Whether you’re looking for life insurance in Bentonville AR, term life insurance, health insurance, home insurance, or any other coverage, our team of experienced professionals is here to help you make the right choices for your unique needs.

Frequently Asked Questions

Does term life insurance have a cash value

No, term life insurance does not have a cash value. Unlike permanent life insurance policies such as whole life or universal life insurance, term life insurance is a pure protection policy that only provides a death benefit to the beneficiaries if the insured passes away during the policy term. Once the term ends, the coverage also terminates, and there is no accumulated cash value to access or withdraw.

How does term life insurance work

Term life insurance works by providing coverage for a specific period, known as the term. The policyholder pays regular premiums to the insurance company to maintain coverage during the term. If the insured person dies while the policy is in force, the insurance company pays out a death benefit to the designated beneficiaries.

How does a term life policy differ from cash value life insurance?

The main difference between a term life policy and cash value life insurance lies in the duration of coverage and the presence of a cash value component. Term life policies offer coverage for a specified term (e.g., 10, 20, or 30 years) and do not accumulate cash value. In contrast, cash value life insurance, such as whole life or universal life, provides lifelong coverage and builds cash value over time, which can be accessed or borrowed against.

How does term life insurance differ from permanent life insurance?

The main difference between term life insurance and permanent life insurance is the coverage duration. Term life insurance provides coverage for a specific term, whereas permanent life insurance covers the insured for their entire life. Permanent life insurance also includes a cash value component that can grow over time.

How are term life insurance premiums calculated?

Term life insurance premiums are determined based on various factors, including the insured’s age, health condition, lifestyle choices, coverage amount, term length, and the type of policy chosen. Younger and healthier individuals typically pay lower premiums.