Split-dollar life insurance is a financial arrangement where two parties, typically an employer and an employee or a business and an owner, share the ownership and benefits of a life insurance policy. If you’ve ever wondered, what is split-dollar life insurance? This post will explain how it works, including the structure of split-dollar life insurance agreements, and its benefits and use cases.

How Split-Dollar Life Insurance Works

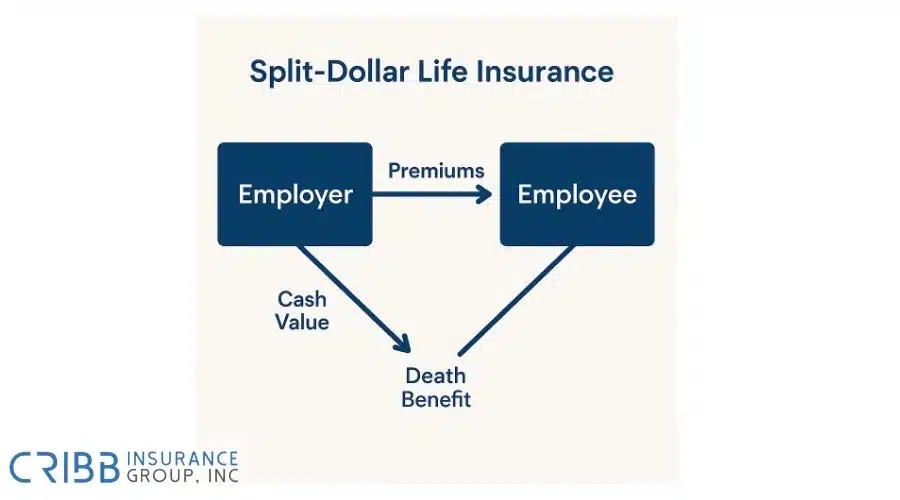

Split-dollar life insurance is not a type of policy, but rather a strategy used to divide the costs and benefits of a permanent life insurance policy between two parties. Typically, one party (like an employer or business) pays all or part of the premiums, while the other party (usually the insured person) receives some or all of the policy benefits. There are usually two main components involved:

- Premium Payments: One party funds the policy premiums.

- Benefit Sharing: The death benefit and cash value are split based on a written agreement.

This setup allows one party to gain insurance protection or wealth-building benefits, while the other party can get repaid for the premiums they have contributed.

Common Types of Split-Dollar Agreements

There are two main types of split-dollar life insurance agreements. Understanding the difference is key to knowing how they are taxed and how benefits are shared.

Loan Regime

Under a loan regime, the company pays premiums and treats the payment as a loan to the employee. The employee agrees to repay the premiums, often from the policy’s cash value or death benefit. Interest is charged based on IRS rules.

Economic Benefit Regime

In this case, the employee owns the policy, and the employer is only entitled to a portion of the death benefit equal to the premiums paid. The value of the “economic benefit” the employee receives each year is taxed as income.

Both methods have different tax outcomes, so selecting the right one depends on your financial goals and the structure of your business or estate plan.

Benefits of Split-Dollar Life Insurance

Split-dollar life insurance can offer several unique benefits for individuals and businesses:

- Cost Sharing: Allows one party to help fund another’s life insurance plan.

- Asset Protection: Helps high-net-worth individuals pass wealth while keeping assets protected.

- Executive Benefits: Offers attractive benefit plans for key employees or business owners.

- Estate Planning: Can help reduce estate tax impact when structured properly.

These benefits make it a valuable tool for strategic financial and succession planning, especially in businesses that want to retain top talent or in families managing complex estates.

Split-Dollar Life Insurance Tax Considerations

Tax treatment of split-dollar life insurance varies based on the type of agreement:

- Loan Regime: The insured may owe interest on the loan or be taxed on the interest benefit if it is not paid.

- Economic Benefit Regime: The insured is taxed on the value of the insurance coverage provided.

It’s essential to structure the agreement properly to avoid unintended tax consequences. Consulting with a financial advisor or tax professional is strongly recommended before setting up a plan.

Is Split-Dollar Life Insurance Right for You?

Split-dollar life insurance is best suited for:

- High-net-worth individuals looking for tax-efficient estate planning tools

- Business owners who want to offer executive benefits

- Companies seeking flexible compensation strategies for top talent

It is not a one-size-fits-all solution. These plans must be tailored to the specific goals and financial profiles of those involved.

Ready to Explore a Split-Dollar Life Insurance Strategy?

Split-dollar life insurance can be a smart strategy for those with complex financial goals or business structures. But it’s crucial to have a well-crafted agreement and expert guidance. At Cribb Insurance Group Inc, we specialize in helping clients navigate life insurance in Bentonville with confidence. Call us today to learn how split-dollar life insurance might work for you.

Frequently Asked Questions

Can split-dollar life insurance be used in a trust?

Yes, split-dollar life insurance can be held in an irrevocable life insurance trust (ILIT) to help manage estate taxes and keep the policy proceeds outside the taxable estate.

Is split-dollar life insurance only for businesses?

No, split-dollar life insurance can be used in both business and personal estate planning. It’s commonly used by families and individuals for wealth transfer strategies.

Who owns the policy in a split-dollar agreement?

Ownership depends on the agreement type. In loan regimes, the employee usually owns the policy. In economic benefit regimes, the employer may be the owner and control the cash value.

Can split-dollar life insurance be changed or canceled?

Yes, the agreement can include terms for changes or termination. Both parties must agree to any modifications, and changes should be documented in writing.

What happens to the policy if the employee leaves the company?

If the agreement ends due to departure, the policy terms decide who keeps the policy or gets reimbursed. Often, the employee may repay the premiums, or the employer retains a share.