If you’re exploring life insurance options, you may ask, what is a participating life insurance policy? A participating insurance policy is a type of life insurance that may pay you dividends or bonuses over time, depending on how well the insurance company performs financially. These policies are popular among people who want long-term value and extra financial benefits. This guide will explain how it works, what sets it apart from non-participating policies, and whether it may fit your needs well.

How Does a Participating Life Insurance Policy Work?

A participating life insurance policy shares the insurer’s profits with you, the policyholder. When the insurance company earns more money than expected—through investments, fewer claims, or reduced costs—it may return part of that profit to you as dividends. These dividends are not guaranteed, but they’re a unique feature that sets participating policies apart. Dividends can usually be received in one of several ways:

- As a cash payout

- Used to reduce your premium

- Reinvested into the policy to grow your coverage

- Left to earn interest within the policy

This makes participating life insurance more than just a death benefit—it becomes a long-term financial tool. While it generally has higher premiums than non-participating policies, many policyholders appreciate the extra value it can bring over time.

Participating vs. Non-Participating Life Insurance

Understanding the difference between these two types of policies helps you make a more intelligent decision. A participating policy allows you to receive dividends based on the insurance company’s performance. These dividends can grow your policy’s value or help reduce your out-of-pocket costs. In contrast, a non-participating policy does not pay dividends. It offers fixed terms, predictable premiums, and a guaranteed payout when the insured dies—but no opportunity to share in profits. Here’s a quick comparison:

| Feature | Participating Policy | Non-Participating Policy |

| Dividends | Possible (not guaranteed) | None |

| Premiums | Usually higher | Usually lower |

| Flexibility | Offers options for dividend use | Fixed benefits |

| Cash Value Growth | May increase with dividends | More limited |

If you’re seeking predictability, a non-participating policy might suit you. If you’re open to long-term gains, a participating policy could be a better fit.

What Are the Benefits of Participating in Life Insurance?

Participating life insurance policies offer several financial advantages that go beyond basic coverage. These benefits make the policy more attractive to people who want life insurance that also works as a long-term financial tool.

Key benefits include:

- Dividend Potential: You may receive yearly payouts that reflect how well the insurance company performed.

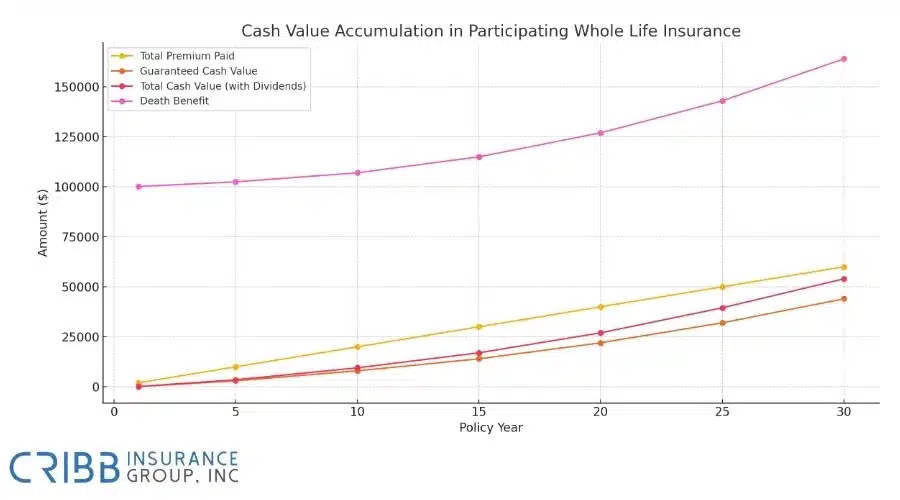

- Cash Value Growth: Your policy can build cash value over time, especially if dividends are reinvested.

- Flexible Use of Dividends: You decide whether to take dividends as cash, reduce your premium, or grow your policy.

- Long-Term Value: Participating policies can serve as protection and as part of a savings or legacy plan.

This makes them a smart choice for individuals who plan to keep their policy for many years, especially those with family or estate planning goals in mind.

Who Should Consider a Participating Life Insurance Policy?

A participating life insurance policy is a strong choice for adults aged 30 to 60 who want more than just a basic policy. It suits financially stable people, plans for the long term, and appreciates the idea of receiving extra value through dividends.

Here’s who might benefit most:

- Individuals planning for family financial protection

- Those building retirement savings

- People looking for tax-advantaged growth

- Anyone who wants both life insurance coverage and investment potential

A non-participating policy may be better if you prefer predictable costs and guaranteed outcomes. But a participating plan is worth exploring if you’re open to more risk in exchange for added value.

Is This the Right Type of Life Insurance for Your Long-Term Goals?

If you’ve been wondering what a participating life insurance policy is and whether it’s right for your future, you’re not alone. At Cribb Insurance Group Inc, we’re here to help you explore your options clearly and confidently. Learn more about life insurance in Bentonville and how this policy can support your long-term goals.

Frequently Asked Questions

What is a participating life insurance policy?

A participating life insurance policy is a type of plan that pays dividends to policyholders. These dividends come from the insurance company’s surplus earnings and may be received as cash, reduced premiums, or added coverage.

How does a participating life insurance policy work?

This policy shares the insurer’s profits with policyholders through dividends. These are not guaranteed and depend on the company’s financial performance, but they can increase the overall policy value over time.

What are the dividends of a life insurance policy?

Dividends are a portion of the insurance company’s profits that may be paid to you as a policyholder. They can be used as cash, to reduce premiums, buy more coverage, or left to earn interest.

Are dividends from participating policies guaranteed?

No, dividends in a participating policy are not guaranteed. They depend on the insurer’s investment performance, claims experience, and other financial factors and may vary each year.

What is the difference between participating and non-participating life insurance?

Participating policies may pay dividends based on company profits, while non-participating policies offer fixed benefits and no dividend payouts. Non-participating plans are generally more straightforward and more predictable.